Strong performance

The ElringKlinger Group launched a global efficiency stimulus program in early 2019 geared toward strengthening its finances over the long term. Three years down the line, the Management Board’s verdict is more than positive: ElringKlinger now boasts a more efficient setup and, armed with all this added strength, can continue to shape the ongoing process of transformation. Read more about the program in the following article.

The sketch for the model, with numerous key financial and earnings indicators and their various interdependencies, seems complex – like a tree branching off in many different directions. And, just like the branches of a tree, the numerous individual measures in ElringKlinger’s global efficiency stimulus program form a single system in which all the elements rely on one another. Management and staff act as the trunk, ensuring stability through their expertise and dedication. Outside influences such as the price of materials, supply chains, and market developments are to the program’s progress what wind and weather are for the tree. Although the roots are hidden from the observer on the surface, they hold the plant in position and keep it supplied with nutrients – similar to how money flows around a company: cash and cash equivalents lay the financial foundation for its operating activities, which in turn generate funds so that it can grow further.

Before ElringKlinger launched its global efficiency stimulus program in early 2019, it had already completed the first step in a long-term strategy: a multi-year cycle of worldwide investment that readied the Group for the impending transformation in the automotive industry. New plants were built in Hungary, at two US sites, in the UK, and in Turkey, while existing premises were kitted out with state-of-the-art manufacturing technology. Capacity was increased significantly at the Suzhou site in China and the plants in Mexico and Brazil. Today, ElringKlinger is geared up for a market that reached a peak of some 95 million new cars and light commercial vehicles in 2018. Customers in all the vehicle markets around the world are served by ElringKlinger’s local production facilities – getting cutting-edge products at a high standard of quality.

"Financial strength is a key factor in the company's lasting success."

Thomas Jessulat, CFO of ElringKlinger AG

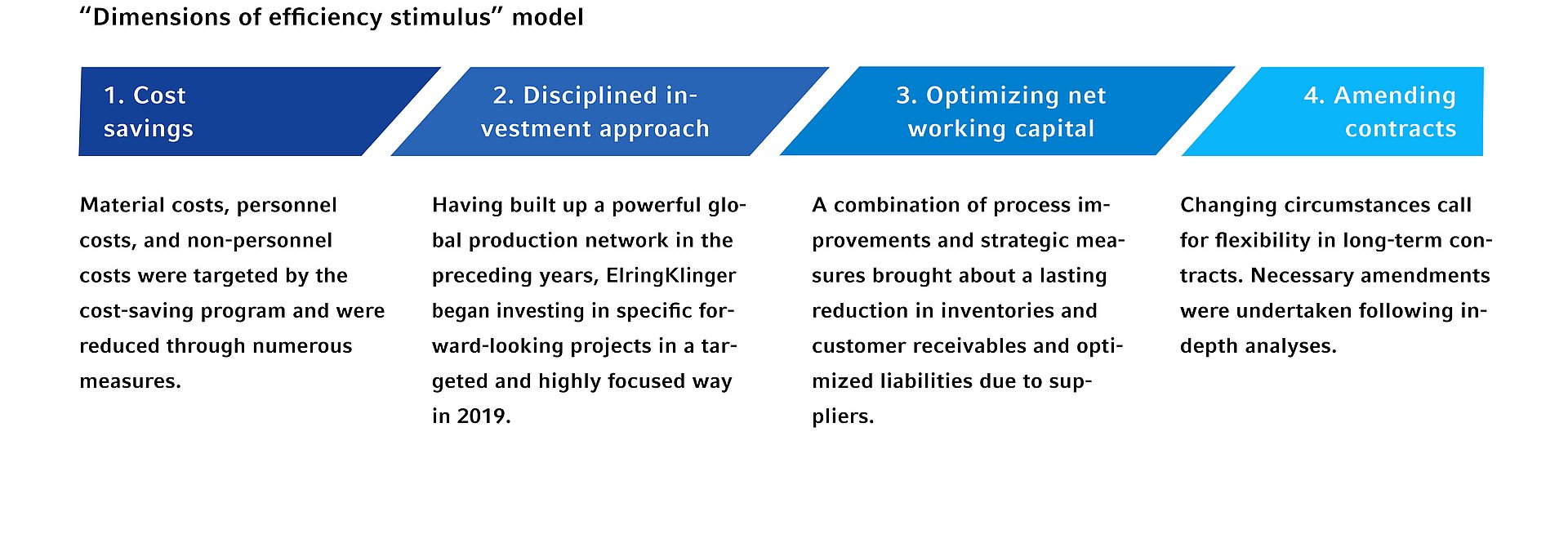

So ElringKlinger was ready for the next step: a targeted efficiency stimulus program to increase its liquidity and profitability over the long term. In this process, CFO Thomas Jessulat focused primarily on improving the company’s financial strength as a key factor in its future success. The program consisted of measures that ultimately formed two main branches: optimizing operating free cash flow1 and increasing EBITDA2. Both were essential steps in significantly reducing net financial liabilities.

Optimizing operating free cash flow

Operating free cash flow is a true indicator of a company’s self-financing capabilities. It results from the company’s operating activities and indicates what financial resources it has generated through its own value creation over a certain period and has at its disposal after deducting investment expenses.

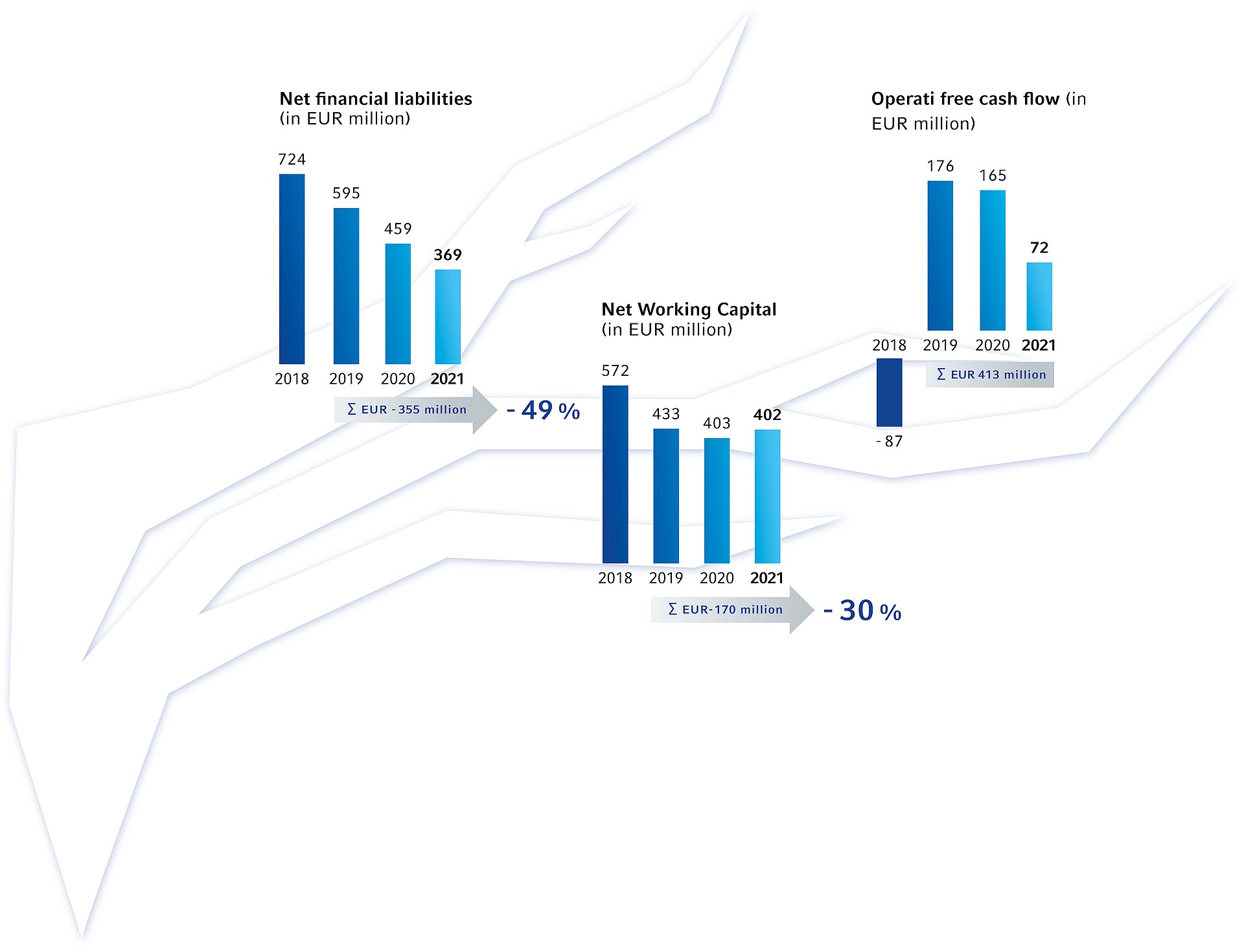

Even as recently as the 2018 financial year, ElringKlinger’s operating free cash flow was still well into negative territory, due primarily to the cycle of investment mentioned above. The efficiency stimulus program tackled both indicators so effectively that ElringKlinger was able to post an impressive operating free cash flow of EUR 176 million as early as the end of the 2019 financial year – followed by a further EUR 165 million in 2020 and another EUR 72 million in 2021. “Our main priority was a sustained improvement to our processes and structures in order to have as long-term an impact as possible,” sums up Thomas Jessulat, looking back.

What specific measures brought about this success? “If you want to unlock liquidity, then your net working capital is a good place to start,” explains a member of the project team from Finance. “If these items on your balance sheet are fluctuating, it will have a direct impact on your financial flows.” Net working capital comprises inventories and receivables due from customers less liabilities due to suppliers.

To tackle the inventories, Supply Chain Management adopted a clear methodology, which started with an ABC XYZ analysis. A specific inventory target, expressed in terms of revenue, was set for the Group and broken down right to the tiniest branches – plants and products – on the basis of a top-down approach. This was followed by bottom-up planning, which determined the ideal amount of raw materials and semi-finished products to hold in stock for each production site and its individual portfolio. The teams also defined upper limits as targets for overall local stock levels. Staff from Supply Chain Management helped their colleagues all round the world to implement this target structure, which was managed in the global IT system. Signs of progress gradually began to emerge. “The Swiss plant started out with its net working capital at 27% of sales,” the project specialist adds. “By the end of the program, this had been reduced to 18%.”

18 %

The Swiss plant entered the efficiency stimulus program in 2019 with its net working capital at 27% of sales. The measures helped bring this down to 18% in three years.

ElringKlinger deployed additional financial instruments to optimize its receivables, while Sales opened discussions with customers in order to shorten payment terms on existing contracts. The payment conditions for new contracts were made correspondingly strict as well. The Purchasing team also went into negotiations with renewed focus. The hard work that everyone in Purchasing and Sales put in paid off. Although Group revenue in 2021 roughly was on a par with 2018’s, it was nonetheless possible to reduce receivables down to a lower level and keep them there, while liabilities due to suppliers were expanded steadily.

On the investment front, the lower expenses from 2019 onward benefited operating free cash flow, while ElringKlinger also continued to improve the corresponding processes: the introduction of a monthly rolling investment plan enabled the disciplined investment approach to be fine-tuned on an ongoing basis. This plan made it possible to react faster and more expediently to changing circumstances such as new orders and market developments. “For us, being disciplined essentially means being focused. We haven’t been neglecting new technologies or highly promising projects for the transformation in our core business in the slightest,” Thomas Jessulat underlines.

Improved EBITDA

Profitability, the second main branch of the program, gives the company greater opportunity to develop since it is the main source to generate additional liquidity. To improve profitability, four areas were analyzed in a first step: material costs, work processes, non-personnel costs, and contractual issues. Owing to ElringKlinger’s high degree of vertical integration, material expenses amount to over 40% of its revenue. Any percentage decrease in this cost item thus has a significantly positive impact on earnings. It can be adjusted by pulling two levers – quantity and price – and both were scrutinized as part of the program. The degree of influence that could be exerted on individual groups of materials was investigated in more detail. Corresponding starting points for action were identified and followed up. This produced two areas for targeting improvements: first, procurement and, second, operating processes and systems that had an impact on quantities.

The Purchasing team focused its strategy more clearly on a total cost of ownership (TCO) approach. In other words, the total costs of a material, i.e., its unit price, transportation costs, and other ancillary procurement costs, were incorporated into the relevant purchasing decision. The origin of materials was also analyzed in detail, allowing more use to be made of regional sources and transportation costs to be reduced. In addition, special circumstances that had generated additional sorting and transportation costs in the past were tackled intensively. The project managers developed stable solutions and standards for issues caused by system-related errors. The various measures have had a positive impact on both a large and a small scale. However, what might sound “small” is not necessarily so. For example, the reject rate has decreased by 0.8% over the past three years. If one considers that it is calculated as a percentage of total production costs, the scale of the improvement becomes clear. Taken together, the effect is considerable: the Group’s materials ratio fell to 42% in 2020 compared with 46% in the 2019 financial year. The savings made also had an effect in the 2021 financial year just ended. However, the headwind on the markets caused by price rises and supply bottlenecks had a disproportionately large impact, pushing the ratio up again to 44%. More savings were also made by optimizing processes, particularly in Production. In Administration, too, workflows were further improved and tasks made more efficient with the help of improved software. The staff responsible devised an ideal cost structure for non-personnel costs. This was used to produce targets at Group, plant, and cost type level that were reviewed on an ongoing basis and adjusted if required.

The fourth field of action was chiefly a job for the Sales team. Costings, including for existing contracts, were reviewed using a clear methodology and areas for action were determined. Any necessary amendments were made wherever the circumstances had changed, particularly in the case of long-term contracts.

Cross-company working basis creates transparency

A uniform basis for everyone working on the project was key in order to improve efficiency across the board. The belief that financial figures such as EBIT, ROCE, and cash flow can be influenced in a targeted way by operating parameters helped ElringKlinger to devise a program-specific system of key performance indicators (KPIs). To this end, all Vice Presidents – who occupy the level of management below the Management Board – were actively involved, and the operating processes were scrutinized from top to bottom. This produced 45 KPIs divided into five categories: finance, operations, HR, sales, and innovations. For each individual KPI a certain Vice President took responsibility. The interdependencies between individual KPIs within the various areas of operations but also between operational progress and financial impact were illustrated in a structured and transparent way. This allowed the progress made to be visualized and measured. However, the decisive factor with regard to the success achieved was that the individual measures were integrated into day-to-day business.

Taking stock after three years

At the end of 2021, management delivered a very positive verdict: key financial indicators have improved considerably, and liquidity has increased significantly over the past three years. Within this period, ElringKlinger has generated over EUR 400 million in operating free cash flow, enabling net financial liabilities3 to be cut by EUR 355 million – i.e., by more than half – in the same timeframe. Having totaled EUR 723 million at the end of the 2018 financial year, net financial liabilities fell to EUR 369 million by the end of 2021. The debt ratio4 improved from 3.7 to 1.7.

"We now have much more strategic room for maneuver. So we'll be able to continue playing an active, key role in helping to shape the ongoing transformation."

Dr. Stefan Wolf, CEO of ElringKlinger AG

Profitability also rose gradually, as reflected in the results. Posting revenue of EUR 1.6 billion in the 2021 financial year, ElringKlinger achieved an operating result (EBIT) of EUR 102 million, or 6.3% of revenue. In 2019, it had still stood at 3.5%. Even in 2020, an unprecedented year due to the coronavirus pandemic, ElringKlinger managed a positive margin of 1.9%.

The positive effects become even clearer when net working capital (inventories plus trade receivables and trade payables) is considered: although Group revenue was only four percent below 2018 levels in 2021, net working capital was successfully reduced by 30% or EUR 170 million. ROCE (return on capital employed), an important indicator for Group management, increased from 5.5% in 2018 to its current level of 6.4%.

6.4%

The program’s success lifted the ElringKlinger Group’s ROCE (return on capital employed, an indicator of profitability) up from 5.5% in 2018 to 6.4% in 2021.

The Management Board’s assessment strikes a quite satisfied note. Dr. Stefan Wolf, CEO of ElringKlinger AG, summarizes the situation thus: “The success we’ve had with the program has given us much more strategic room for maneuver. Today, the Group is strong enough continue its active role in helping to shape the ongoing transformation both in our traditional fields of business and with the new technologies.” Thomas Jessulat adds: “We’re in a position to make strategic investments under our own steam at any time. So we’ve achieved a great deal, but we won’t be resting on our laurels, of course.”

Outlook

After completing the efficiency stimulus program, the Group is moving on to a new chapter, which is based on four areas of great relevance to the future: e-mobility players, a focus on the KPI system, process excellence, and digitalization. The Group intends to keep on evolving toward an ambitious target structure. It will be focusing on digitalization and process excellence internally, while keeping its outward-facing eye even more closely on its customers, the markets, how they are developing, and what potential they hold. “In Sales, we’ll be acquiring a larger number of innovative projects that’ll allow our traditional business to showcase its transformation expertise,” says a member of the project team.

While e-mobility and non-automotive components are becoming a growing part of its business and its portfolio is continuing to evolve with the addition of new components, the company is also changing. Just like a tree, it is striving for growth. There will be periods of regeneration and harvest, accompanied by constant change. Dr. Wolf is in no doubt: “The next few years are going to be exciting. Whoever wants to assert themselves on the market will need to have done their preparations a long time ago. ElringKlinger is more ready for the future than it’s ever been.”

1 Cash and cash equivalents from operating activities left over after deducting expenditure on investments

2 Earnings before interest, taxes, depreciation, and amortization

3 Financial liabilities less cash and cash equivalents, also known as net debt

4 Ratio of net financial liabilities to EBITDA