![[Translate to English:] Geballte Power [Translate to English:] Geballte Power](/fileadmin/data/images/05-investor-relations/pulse/2023/12-concentrated-power/elringklinger-pulse-2023-header-concentrated-power_en.jpg)

Concentrated Power

The debate over the mobility of the future is frequently presented as a straight choice: batteries or fuel cells. Often, statements are put forward in support of only one of the two technologies. However, this approach is short-sighted: backing both batteries and fuel cells makes logical and economic sense.

The fuel cell harnesses the benefits of hydrogen as an energy source, primarily its ability to be consumed at a different time and in a different place to when and where it was produced. Via its subsidiary EKPO Fuel Cell Technologies, ElringKlinger supplies complex components as well as high-powered stacks, whose high performance density generates concentrated power.

The next few pages explore the major contribution that the fuel cell can make to the mobility of the future.

598

cells in EKPO Fuel Cell Technologies’ NM12-twin fuel cell stack generate 205 kW of power.

The mobility transformation is well under way. A key question is how and what the transportation sector can contribute to a cut in greenhouse gas emissions. After all, road passenger and freight transport is responsible for some 20% of global CO2 emissions. A raft of regulations have been imposed in recent years in a bid to lower these emissions significantly. For instance, passenger cars will need to emit 37.5% and light commercial vehicles 31% less CO2 in 2030 than in the reference year (2021). Meanwhile, heavy-duty commercial vehicles weighing more than 12t will be required to reduce their CO2 emissions by 15% by 2025 and by 30% by 2030 compared with the reference year (2019).

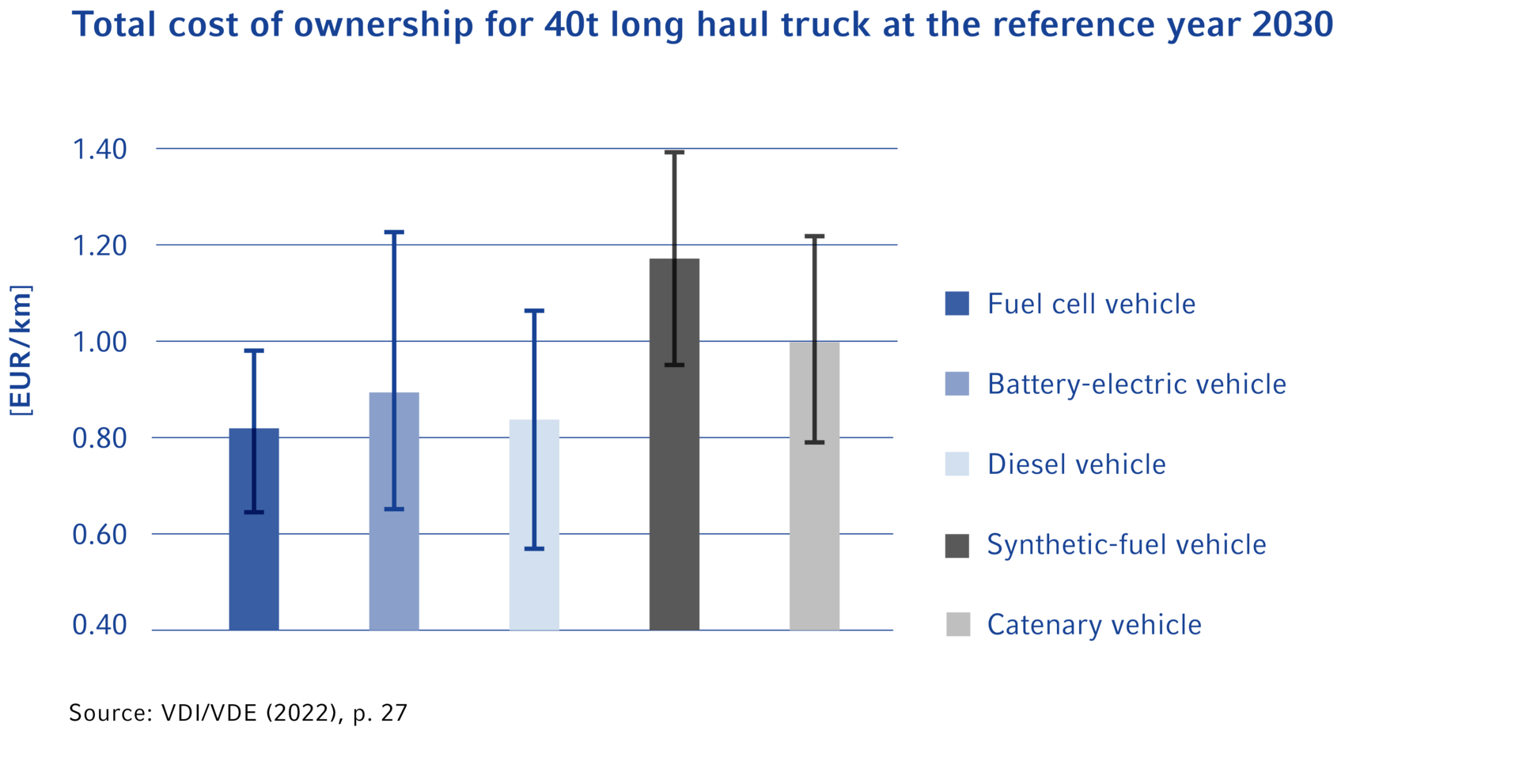

These targets stand no chance of being met just with vehicles powered by a combustion engine. Instead, alternative drive technologies must be embraced as well in order to achieve the objectives. If one compares the total costs of various alternatives, both vehicles fitted with overhead wires and those powered by synthetic fuels will cost more over the long term according to a recent study by the VDI and VDE.1 Thus, battery-electric and fuel cell vehicles are more cost-efficient. Both technologies offer benefits and have a role to play in the mobility of the future. Contrary to popular belief, the two technologies are actually complementary and will be best placed to handle the transformation if they work together. Rather than an “either/or,” therefore, it is a case of “both/and.” If you look at the registration figures for commercial vehicles, battery technology is ahead by a nose compared to fuel cell technology, as it is in the passenger car segment too. While there were as many as 435,000 battery-electric light-duty commercial vehicles on the world’s roads by late 2020, there were only 3,160 fitted with a fuel cell drive. And it is a similar situation with buses. This is because battery technology is more market-ready than its fuel cell counterpart according to the VDI/VDE study (85% as against 73%).

One frequently cited argument revolves around efficiency, which is usually measured using the “well-to-wheel method,” i.e., from the energy supplied as electricity through to consumption within the vehicle. Viewed solely from this angle, the electric drive is superior. Focusing just on efficiency does not give the full picture, however: mobility means more. For this reason, cost-effectiveness must instead be considered across the board and the overall costs (“total costs of ownership”) of the different vehicle versions have to be compared accordingly.

Doing so reveals no significant difference in acquisition costs between battery-powered and fuel cell vehicles, e.g., in heavy-duty transport.2 Whether one or the other is more beneficial over long distances depends on whether the variable costs can be kept low. However, it only makes sense to consider cost-effectiveness if – and this is a big if – the necessary charging or refueling infrastructure is also in place, ideally across the board but at least along the routes being traveled. As far as fuel cell vehicles are concerned, the existing network of gas stations can be converted. Although this would cost over EUR 1 million per station, only around 1,000 are expected to be needed in Germany to secure nationwide coverage. There are currently more than 14,000 gas stations for fossil fuels in Germany. The existing power grid would have to be substantially expanded to handle battery-electric vehicles. At the same time, solutions need to be found for the centers of big cities, where vehicles cannot be charged at home in the garage but spend the night out on the street. Both alternatives will require correspondingly high investments in infrastructure.

6,2

kW/l is achieved by the EKPO stack range inside the cell block. This performance density makes EKPO Fuel Cell Technologies the market leader.

In addition, both technologies are likely to become even more efficient in the future. At the same time, mass production is set to reduce the acquisition costs per unit, which should benefit the fuel cell more in view of its degree of maturity. The production costs of hydrogen are also expected to fall, because the hydrogen industry is not yet fully developed and extensive plans such as the German government’s National Hydrogen Strategy have yet to really take effect.

Generating hydrogen requires energy – energy that, in a battery-electric vehicle, can be used straight away for the drive without having to be stored via hydrogen in the interim. In that case, however, the electrical energy also needs to be used straight away, because storage capacity is limited. But hydrogen offers the major advantage of being storable – once it has been generated. This means that it can be stored as an energy source, in tanks or caverns for instance, until it is needed for mobility. This breaks the link between the times at which the energy is generated and consumed. Hydrogen can also be transported along existing pipelines.

Overall, this is an advantage in terms of the time and place it is consumed as well as the time it is produced, because peaks in demand through the day, week, and year can be smoothed and periods of underutilization used to generate hydrogen. In other words, where and when the hydrogen is produced is irrelevant, and neither does it matter where or when it is used.

Making hydrogen part of an energy policy strategy will enable the availability risk to be mitigated. In Germany, for instance, the energy transition has three if not four different priorities: the (1) phase-out of coal has been decided alongside (2) the discontinuation of nuclear power. At the same time, (3) mobility is to run on electricity. In addition, the (4) demand for energy is continuing to increase as a result of automation and the onward march of technology. Unless hydrogen is incorporated into the energy policy measures, all that will be left to cover the huge demand will be renewables such as solar, wind, and hydropower.

The German government has sketched out the path ahead with its National Hydrogen Strategy:3 Hydrogen is to become established as an energy source in Germany in order to make energy supply secure, environmentally friendly, and more self-sufficient. France and many other industrialized nations have launched similar initiatives. Sector coupling envisages the widespread use of hydrogen to close the gap in energy supply while driving forward the decarbonization of industry. As well as the production of hydrogen, the import of so-called green hydrogen is also expressly part of the strategy. Only recently, the German government announced new terminals at the mouths of the Weser and Elbe rivers for importing liquefied petroleum gas first of all, followed later by hydrogen.

The National Hydrogen Strategy also goes one step further: the transportation and distribution infrastructure for hydrogen is to be upgraded by developing and expanding existing networks. Germany is also ploughing significant funding into projects to create a European value chain for the hydrogen industry (the “IPCEI on Hydrogen”). And, incidentally, ElringKlinger’s subsidiary EKPO Fuel Cell Technologies has already been preselected by the German government to be part of this project for developing a new generation of fuel cells. The preselection still needs to be rubber-stamped at European level.

Hydrogen is to become established as an energy source in Germany in order to make energy supply secure, environmentally friendly, and more self-sufficient.

In summary, comparing the total costs of battery and fuel cell technology reveals two things:

(1) Looking at the individual drive types, fuel cell vehicles are the cheapest alternative in certain applications, such as heavy-duty traffic, and considering a time horizon to 2030.4

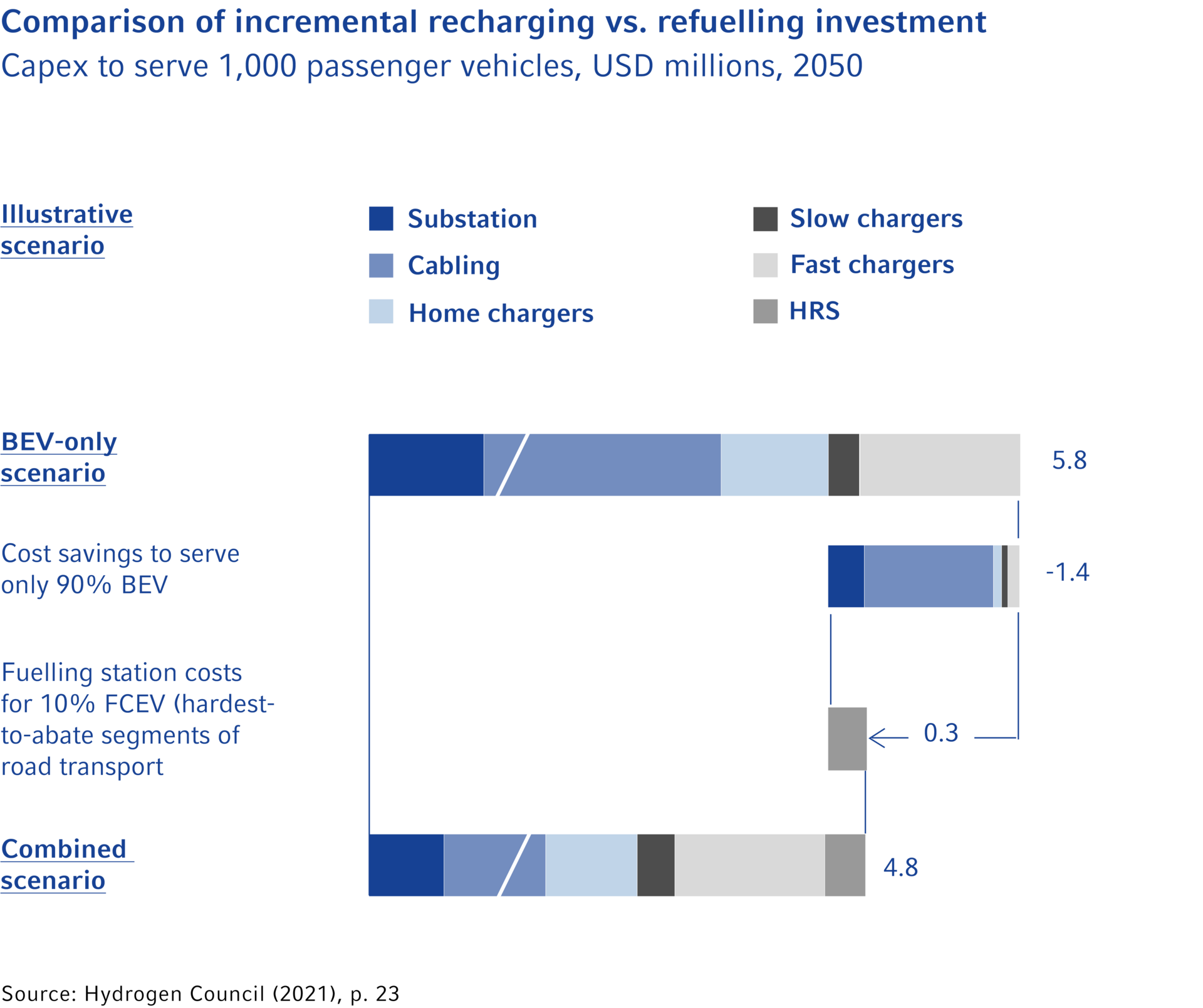

(2) With regard to total energy costs including infrastructure, backing both battery and fuel cell technology will generate synergy effects. For instance, charging a large number of battery-powered trucks and cars at the same time at a highway service area requires a similar amount of energy as a small town.5 Meeting such a demand would require expanding the network at significant expense.

However, this will cost less overall if hydrogen is used on a complementary basis and the charging infrastructure does not need to be designed with such peak loads in mind. A study by the Hydrogen Council suggests that this would save Germany investments worth some EUR 36 billion viewed over the economy as a whole.6

The mobility transformation is clearly posing new challenges. Picking the right technology is one of them. Homing in on just one too soon is short-sighted, because batteries and fuel cells in combination are proving to be more cost-effective overall and, in view of the risks posed by new technologies, the sensible option as well. Ultimately, both batteries and fuel cells are efficient ways of achieving the common aim of significantly reducing CO2 emissions and making mobility environmentally sustainable.

"EKPO Fuel Cell Technologies is headquartered in Dettingen/Erms, Germany, where up to 10,000 fuel cell stacks a year can already be manufactured to automotive industry standards – and that number is set to rise."

Dr. Gernot Stellberger, General Manager of EKPO Fuel Cell Technologies GmbH

Dr. Stellberger, why is fuel cell technology so important for the future?

Dr. Gernot Stellberger: Battery-electric vehicles cannot carry the mobility transformation on their own. Taking all the costs into account, neither synthetic fuels nor vehicles fitted with overhead wires are as economical as batteries and fuel cells. Fuel cells will start by conquering the market wherever, for instance, there’s high energy demand and having downtime for charging batteries is costly from a “total costs of ownership” perspective.

Where would that be?

Stellberger: Particularly in heavy-duty and long-haul road transport, i.e., including long-distance buses and coaches. The kind of frequent charges that a battery-electric drive needs on a long journey means that it’s fairly often at a standstill. And downtime costs money.

Up until now, however, many more battery-electric vehicles have been manufactured and registered. Demand for fuel cell vehicles remains low.

Stellberger: This is because battery technology is still slightly ahead in terms of its technological and industrial market-readiness thanks to all the funding that’s been pumped into it in recent years. However, this gap will close when more vehicles fitted with new drive technologies are registered, since larger volumes significantly reduce the price per unit, particularly with fuel cell drives. And, the lower the unit price, the more attractive and competitive the technology.

We’re expecting fuel cells to become popular for commercial vehicles, buses, and logistics applications first of all. From 2026 onward, you’ll also see more heavy-duty SUVs and passenger cars designed for long distances as well as maritime applications, for instance, being equipped with the technology. And don’t forget that we’ll also be heading into the “third dimension” with our partner Airbus toward the end of the decade. The fuel cell now has momentum.

What does that mean for EKPO Fuel Cell Technologies?

Stellberger: We’re going to be steadily increasing our revenue from fuel cell stacks and components to reach somewhere between EUR 700 million and EUR 1 billion in 2030. Our advantage is that we can now offer the right market-ready products at the right time – powerful stacks and technologically sophisticated components such as the bipolar plate, manufactured in a professional industrial environment.

What markets are you looking to serve with this?

Stellberger: Our products already meet the market requirements for many different applications, including both on-road commercial vehicles and logistics. However, you’ll also find our stacks on water, in forklifts, or in aviation. And we’re reinforcing our position as a technology leader with a performance density of over 6.0 kW/l.

When will we be seeing EKPO stacks and components in series production?

Stellberger: Our first series order, with a total volume in the high double-digit million euro range, is set to get under way as early as 2022. Our 20-year incubation at ElringKlinger, one of our two parent companies, has given us a lot of skills and significant expertise. It means that we’re already able to manufacture on an industrial scale, something that others have yet to achieve. We can already make up to 10,000 stacks a year to automotive industry standards and are poised to harness the fuel cell’s momentum, both in the automotive sector and for other non-automotive applications.

Dr. Stellberger, thank you very much for talking to us.

1 See VDI/VDE: Climate-friendly commercial vehicles. A comparison of various technology pathways for carbon-neutral and zero-carbon drives, January 2022, www.vdi.de/ueber-uns/presse/publikationen/details/klimafreundliche-nutzfahrzeuge, retrieved on March 3, 2022.

2 See. VDI/VDE (2022).

3 See BMWi: National Hydrogen Strategy, Berlin, June 2020, www.bmwi.de/Redaktion/DE/Publikationen/Energie/die-nationale-wasserstoffstrategie.pdf?__blob=publicationFile&v=12, retrieved on March 3, 2022.

4 Vgl. VDI/VDE (2022).

5 See Hydrogen Council: Roadmap towards zero emissions. The complementary role of BEVs and FCEVs, Brussels, September 2021, https://hydrogencouncil.com/wp-content/uploads/2021/10/Transport-Study-Full-Report-Hydrogen-Council-1.pdf, retrieved on March 3, 2022.

6 See Hydrogen Council (2021).